How To Hedge Bets

TIPS FOR HEDGING YOUR BETS. PLAN BEFORE PLACING THE INITIAL BET. Bettors mostly end up hedging when they get close to winning a bet that they didn’t think would have a chance of. WEIGH THE RISK AND REWARD. PREPARE ADDITIONAL FUNDS. CHECK YOUR MATH MULTIPLE TIMES. CHECK THE PARAMETERS OF BOTH BETS. To use our hedging calculator, simply add the price of your pre-game bet under “My Odds” and the bet amount. Then add the current price under “Hedge Odds” and the calculator will automatically calculate how much you need to bet to lock in a profit.

- Basically, hedging is just a way to reduce or eliminate the risk of a bet. You would generally look to hedge a bet when you are no longer comfortable with the bet you have made – i.e. You don’t think you have a particularly good chance of winning. The simplest example of a hedge is a bet on the other side in the game in question.

- Hedge Stake = Original Stake / (Hedge Decimal Odds – 1) For example, say you bet $100 on the Jaguars to win the Superbowl at (+1000) early in the season. However, they’re up against the Patriots in the Super Bowl. The Patriots are listed at (-200). You’ve decided you want to guarantee you make your money back.

- Hedge one's bets Lessen one's chance of loss by counterbalancing it with other bets, investments, or the like. For example, I'm hedging my bets by putting some of my money in bonds in case there's another drop in the stock market. This term transfers hedge, in the sense of 'a.

Hedge betting is a sports betting strategy that most bettors

are at least vaguely aware of. This doesn’t mean that they all

fully understand how to use it effectively or that they

know why and when they should consider hedging a bet. As a

result, the strategy is often used incorrectly or for the wrong

reasons.

The purpose of this article is to provide some clarity on

exactly what the hedge betting strategy is all about. We’ll

explain the fundamental concept and look at why it’s a strategy

worth considering. We’ll also provide some examples of when it

can be used, and why, and look at its advantages and

disadvantages. We’ll provide some helpful tips for using the

strategy too.

Hedge betting is often confused with arbitrage betting. There are similarities between these two

strategies in that they can both involve betting on all outcomes of the same event, but they are used in

different ways and for different reasons. We’ll briefly cover the difference between the two strategies

in this article, and we’ve also written an article that offers a detailed explanation of how arbitrage

betting works.

The Basics of Hedge Betting

The best way to view hedge betting is to think of it as a

form of insurance. It’s actually a relatively straightforward

strategy at its core, with the basic idea being to protect

existing bets against potential losses. This is done by betting

on outcomes that are different to the original wager. For

example, you could bet on the favorite to win an upcoming

football match having already bet on the underdog to win.

On the face of it this doesn’t seem like a very sensible

thing to do, as betting on both teams to win a football match

will usually result in a guaranteed loss. There are, however,

some situations when hedging a bet makes a great deal of sense.

The strategy can be used to reduce risk that you may no longer

wish to be exposed to, and in certain circumstances can even be

used to guarantee profits.

The Difference Between Hedge Betting and Arbitrage Betting

The primary difference between hedge betting and arbitrage betting is the way in which

the two strategies are used. Arbitrage betting involves placing two or more wagers on

different outcomes simultaneously. It can be used only when a discrepancy between the

odds being offered by different bookmakers creates the right kind of opportunity. Its

purpose is solely to guarantee profits based on that discrepancy.

In contrast, hedge betting involves placing additional wagers on a different outcome

or outcomes subsequent to an original wager being placed. The strategy is usually used

following some kind of change in circumstance. Its purpose, as we’ve already discussed,

is to either reduce risk or guarantee profits.

Why Use Hedge Betting?

Before you think about using the hedge betting strategy, you

should understand why it can be beneficial to do so. We’ve

mentioned how it can be used to reduce risks or guarantee

profits, so let’s explore these two reasons in some more detail.

Hedge Betting to Reduce Risk

Hedge betting to reduce risk typically involves taking a

small guaranteed loss to avoid the possibility of making a

larger loss. There are a few reasons why you might want to do

this, with the most common being that you have placed a wager

and no longer have any confidence in it winning. This can be due

to simply having doubts about why you placed the wager in the

first place, or something could happen to affect your views on

the chances of it winning.

What Does Hedging A Bet Mean

For example, let’s say you placed a $100 point spread wager

on the Tennessee Titans for an upcoming football match against

the Tampa Bay Buccaneers. At some point before the game starts

you have a change of heart about the bet, and no longer want to

be exposed to the potential $100 loss. Maybe the quarterback has

just got injured, or maybe your instinct is telling you that you

made a bad bet in the first place.

Rather than let the bet ride, you could choose to hedge it by

placing a $100 point spread wager on the Buccaneers too.

Assuming the line hasn’t moved, one of the two wagers is

guaranteed to win. You’ll lose a little bit of money as the odds

for both bets will both be just below evens, but your loss will

only be a fraction of the $100 you were originally exposed too.

Hedge Betting to Guarantee Profits

Depending on the types of wagers you place, there may well be

occasions when you can use hedge betting to guarantee profits.

An example could be if you placed a wager on a team to win the

Super Bowl at the start of the season and then that team made it

to the Super Bowl final. You could hedge that wager by placing

another one on the other team to win the Super Bowl. If you got

the math right then you could create a situation where you make

an overall profit regardless of which team wins.

Another example would be if you placed a six team parlay or

accumulator, and the first five teams you backed all won. You

would then stand to make a sizable profit if the sixth team won

too, but stand to make nothing if it didn’t. At this point you

could place another wager on the opposing team to win, and again

you would be able to guarantee an overall profit.

Hedge Betting Examples

Now that we’ve explained the basics of hedge betting and why

you might want to use it, we’ll show you a few examples of some

hypothetical scenarios to illustrate exactly how you can use it.

In each of these examples we will be using the decimal odds format. If you’re not

familiar with this format, please take a look at our article where we explain the different

types of odds. We also provide a tool which converts odds into different formats that you

might find useful.

Hedging a Future/Outright Bet

Hedging a futures or outright bet is one of the most common

uses of the hedge betting strategy. The idea here is that, in

the right set of circumstances, you can create a situation where

you are guaranteed to make a profit regardless of whether your

original bet wins or loses.

For the sake of this example let’s say that you’ve placed a

$100 wager on the England soccer team to win the FIFA World Cup,

at odds of 12.00.

Now let’s say that the England team makes it to the final of

the World Cup, where they will be facing Brazil. Your preferred

bookmaker is offering the following odds on which team will lift

the trophy.

As it stands you will make a profit of $1,200 if England wins

the tournament and a loss of $100 if Brazil wins the tournament.

If you are still confident that England will win then you can

just let the bet ride, but you could use hedge betting to make

sure that you will make a profit either way. Let’s say you

decide to cover yourself, and placed a $500 bet on Brazil to

win.

You have now placed a total of $600 in wagers and are

guaranteed to win whatever happens. If Brazil wins you will get

a return of $750, for a total profit of $150. If England wins

you will get a return of $1,300, for a total profit of $700.

Basically you have sacrificed some of your potential profits to

make sure that you cannot lose.

Please note that you can choose how much you stand to profit

on each team winning simply by adjusting the size of the stake

on your second wager. If you staked $300 on Brazil, for example,

your profits would be $50 if Brazil won and $900 if England won.

If you staked $800 on Brazil then your profits would be $300 if

Brazil won and $400 if England won.

Hedging a Parlay/Accumulator

Hedging a parlay or accumulator is another common use of the

hedge betting strategy, and again the idea is to take advantage

of circumstances where it is possible to guarantee some profit.

In this example we’re going to assume that you’ve placed a

six team point spread parlay on the NFL, staking $50 at odds of

41.00.

Now let’s say that the first five teams all win. Your sixth

selection is the Green Bay Packers, and they are playing Chicago

later in the day. At this point you stand to make a profit of

$2,000 if the Packers cover the spread, but a $50 loss if they

don’t. Obviously you can choose to just let the parlay ride, but

you could easily lock in a tidy profit if you wanted.

Because you’re betting on the point spread, the chances are

that a bet on Chicago would be the standard 1.91. A good bet to

make here would be $500 on Chicago.

You have now wagered $550 in total, but you are guaranteed an

overall profit. If Chicago wins your return will be $955 for a

profit of over $400, and if the Packers win you’ll make a profit

of $1,500. As with the example we gave earlier, of hedging a

futures bet, you are essentially just sacrificing some potential

profit to make sure that you definitely come out ahead. Once

again you can choose to adjust the stake of your second wager to

determine how much profit you will make on each outcome.

Hedging Due to a Change in Opinion

Hedging due to a change in opinion is not as common as the

previously mentioned uses of the hedge betting strategy, but

there are times when it can be a sensible action. A large part

of successful sports betting is managing risk effectively, so if

you have a wager in place that you no longer think will win then

reducing your exposure might well be the right thing to do.

For this example we’re going to assume that you’re looking to

place a wager on an upcoming boxing match between Rico Ramos and

Claudio Marrero. The odds at your preferred bookmaker are as

follows.

You like Ramos, so you bet $50 on him to win at 2.50.

However, in the lead up to the fight you feel that Ramos

doesn’t look in his best shape and you change your mind about

his chances of winning. You therefore don’t want to be exposed

to a $50 loss. Seeing as you stand to make a profit $75 if he

does win, you decide to stake that much on Marrero winning.

You now have a total of $125 wagered, which you’ll get back

in full if Ramos wins. If Marrero wins you’ll get back $114.75,

for a loss of $10.25. You can’t make a profit from the fight,

but you’ve minimized your overall risk. The problem is that the

draw is also a possibility, and you’d be exposed to a $125 loss

if this happened. You therefore decide to place a small bet of

$6 on the draw too. This will return $126 in the event of a

draw.

Your total wagered is now $131, with the three possible

outcomes offering the following potential overall returns.

Ramos Wins

$125 returned for $6 loss

Marrero Wins

$114.75 returned for $16.25 loss

Ramos Wins

$126 returned for $5 loss

Obviously this is not an ideal situation to be in, as you

can’t win and are guaranteed to lose. Sometimes it is right to

take a small loss rather than let a bet ride though. In this

example your maximum loss is less than one third of the original

$50 you had at stake, so your overall exposure is reduced.

Hedging In-Play (Example 1)

Most online sports betting sites offer in-play betting these

days. Also known as live betting, this is a feature which allows

you to place wagers on sporting events after they have started.

The hedge betting strategy can be a very useful one to use when

betting in-play, particularly if an event looks like it is going

to turn out different to how you expected.

For this example we’re going to use a tennis match between

Rafa Nadal and Fernando Verdasco. The initial odds at your

preferred bookmaker look like this.

You believe Nadal is going to win the match, so you back him

with a $100 stake.

You decide to watch the match, and after the first few games

it becomes clear to you that Nadal is not at his best. He’s

already had his serve broken, and doesn’t appear to be making

his shots as well as he usually does. At this point you feel

that there’s a very good chance that Verdasco is going to win.

You log back in to your bookmaker and see that the following

odds are now available.

Nadal is still the favorite, but the odds have shifted

somewhat due to Verdasco going for a break up. You decide to

place a $50 bet on Verdasco.

You’ve now wagered a total of $150, with two possible

outcomes.

Nadal Wins

$140 returned for $10 loss

Verdasco Wins

$115 returned for $35 loss

This is another situation that is not ideal due to a

guaranteed loss. However, your overall exposure is significantly

reduced from the original $100. If Nadal turns the match around

and wins then you’ll be $50 worse off than you would have been

if you had let the bet ride, but if Verdasco does go on to win

then you will have saved yourself $65.

Hedging In-Play (Example 2)

You can also use hedge betting in-play to lock in some

profits. Let’s use the same tennis match as above for this

example, and assume that you have again placed a $100 wager on

Nadal to win. After his initial slow start you decide not to

hedge your bet immediately, but instead wait to see how the

first set plays out. Nadal ends up breaking back, and winning

the set on a tie-break. The odds on the match are now as

follows.

How To Hedge Bets In Roulette

The odds on Nadal have now dropped due to him taking the

first set, and the odds on Verdasco have lengthened. You’re

still not convinced that Nadal is at his best though, and you

think Verdasco might just stage a comeback. You decide to hedge

at this point, by placing a $25 wager on Verdasco.

Your total staked is now $125, with the following two

outcomes a possibility.

Nadal Wins

$140 returned for $15 profit

Verdasco Wins

$150 returned for $25 profit

As you can see, you are now guaranteed to make a profit

whatever happens. You’ve forfeited $25 of your potential profit

should Nadal win, but made sure that you will come out ahead

however the match finishes up. This could be a sensible thing to

do if you had genuine concerns about whether Nadal would see the

match out.

Advantages and Disadvantages of Hedge Betting

The advantages and disadvantages of hedge betting are really

quite straightforward. The main advantage of the strategy is

simply that it can give you a great deal of flexibility in

managing the level of risk you are exposed too. If you are close

to landing a big win from a parlay, for example, you can easily

use hedging to play it safe and ensure that you definitely make

some kind of profit. If you stand to make a loss on a wager, and

no longer want to be exposed to that loss, you can use hedging

to reduce the size of that loss.

This extra flexibility can be very useful

when it comes to

practicing good bankroll management. The main disadvantage of

managing your risk in this way is that it comes at a cost. As

we’ve highlighted in the above examples, reducing your risk

exposure can mean that you are guaranteed to take a loss.

Although you can reduce the size of the potential loss from an

existing wager, you also end up sacrificing the potential profit

from that wager. Using hedging to guarantee profits also has an

associated cost, as you are effectively paying a premium from

your potential profits to cover the other side of your wagers.

Hedge Betting – Our View

There are a lot of conflicting views about how this strategy

should be used, and indeed whether it should be used at all.

Some people believe that you should always let existing bets

ride, and that hedging is a bad strategy that costs money in the

long run. Others believe that it is an excellent strategy that

should be considered at every opportunity.

Our view is somewhere in the middle. We very much believe

that it’s a strategy you should understand, as it can be

extremely useful in the right circumstances. It’s important not

to over use it though, as you can end up being overly cautious

and giving away far too much in potential profits to ever be

profitable overall.

Our Top Tip for Hedging Your Bets

How To Hedge Bets In Basketball

How and when you use the hedge betting strategy is, of

course, entirely up to you. You may decide to use it only in

exceptional circumstances, or you may decide not to use it at

all. You may decide to use it frequently in order to keep your

exposure to risk as low as possible. There is no right and wrong

really, but we do have one tip that we recommend you follow.

The important thing with hedging is to judge each situation

on its own merits. We don’t believe that you should have any

hard and fast rules about when to hedge and when not to hedge.

Each time you are in a situation where hedging is worth

considering, you should weigh out the pros and cons and make

your decision accordingly. Basically you need to make sure that

you are hedging for the right reasons, and these reasons will

ultimately depend on your attitude to risk.

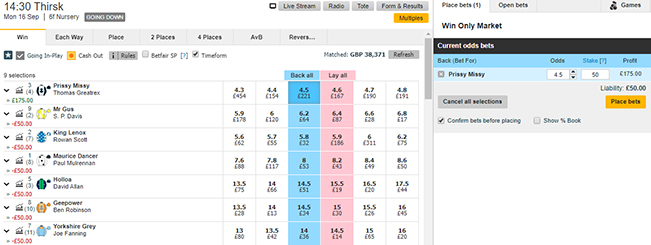

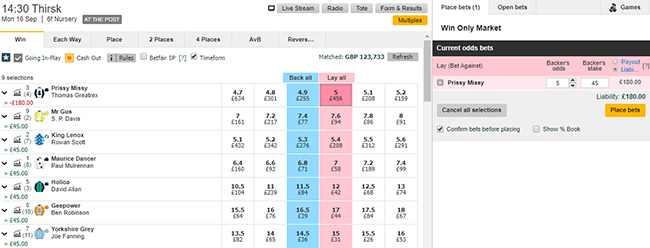

Hedge Betting Using Betting Exchanges

The rise of betting exchanges has opened up a number of additional

opportunities for using the hedge betting strategy, due to the fact

exchanges allow you to lay outcomes as well as back them. We haven’t

covered this aspect of hedging here as we are aware that not everyone

uses betting exchanges, and some of you may not even be familiar with

how they work.

How To Hedge Your Bets

We do provide a detailed guide to using betting exchanges though.

This explains exactly how they work, and also features a great deal of

additional strategy advice specific to exchange betting.